Introduction

Sending money internationally has become convenient with the availability of various platforms that offer speedy and secure services. Whether you are sending money to family members or making payments for goods and services overseas, it is important to be well-informed about your choices. This guide will analyze and compare five well-known services: MoneyGram, Western Union, Remitly, Wise, and Xoom, to assist you in determining the best option that aligns with your requirements.

Money Transfer Platforms

When assessing these money transfer platforms, we focus on important factors such as:

- Exchange Rates: The amount of foreign currency received for your money.

- New user promotion: Discounts, bonuses or promotional exchange rate for new customers.

Platforms

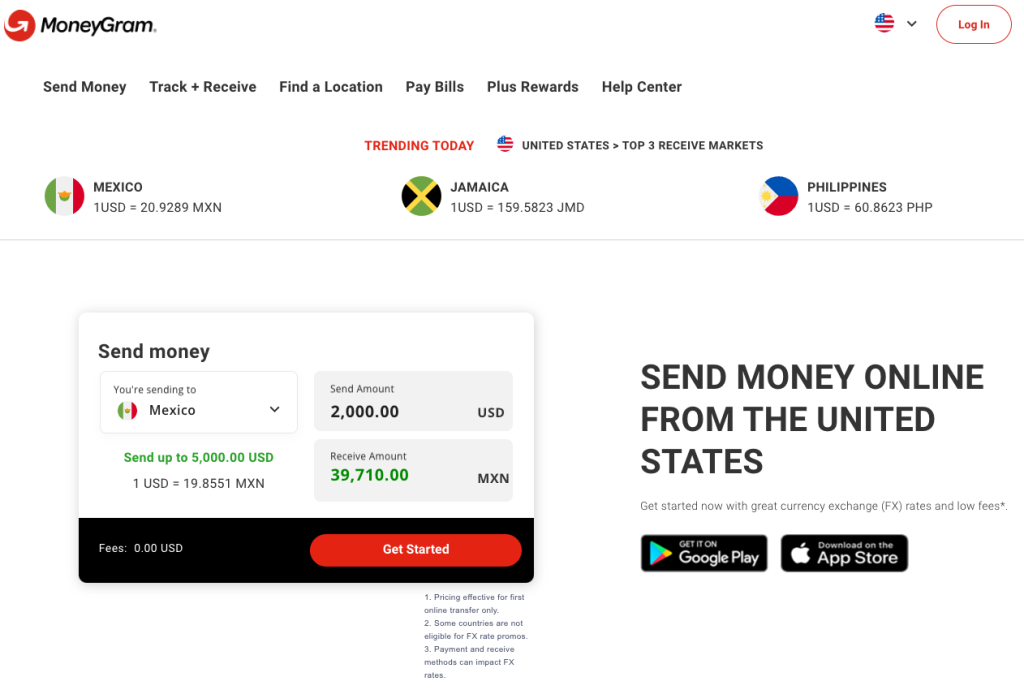

- MoneyGram International, Inc. is a leading American company that specializes in interstate and international peer-to-peer payments and electronic funds transfer services. The company’s headquarters are located in Dallas, Texas, with an additional operations center in St. Louis Park, Minnesota, and various regional and local offices worldwide.

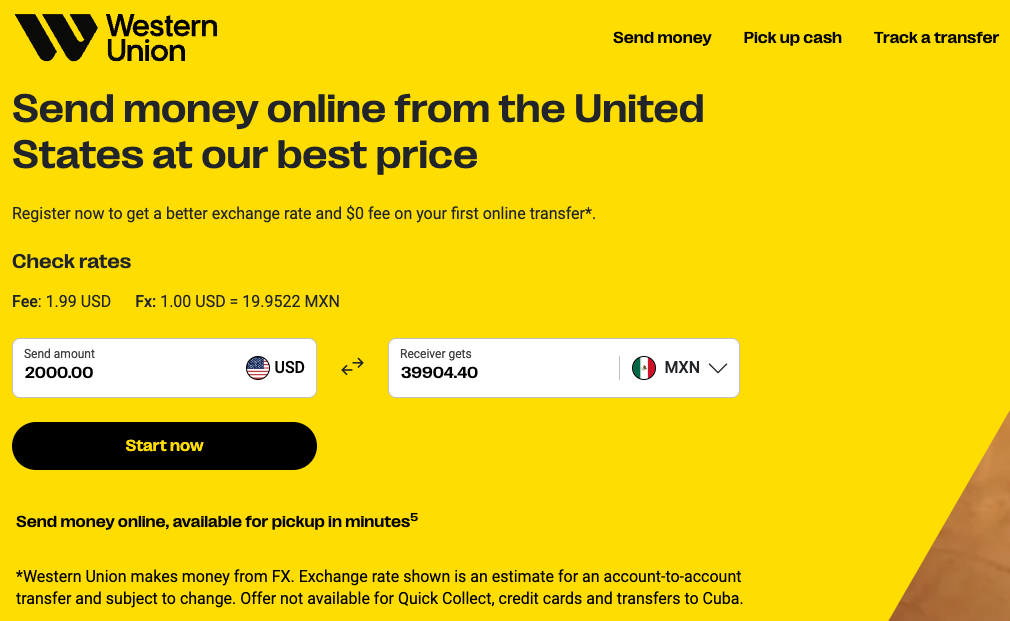

- Western Union is a long-standing (since 1851) and globally recognized money transfer service, offering a vast network of agent locations in over 200 countries, making it ideal for cash pickups and fast international transfers.

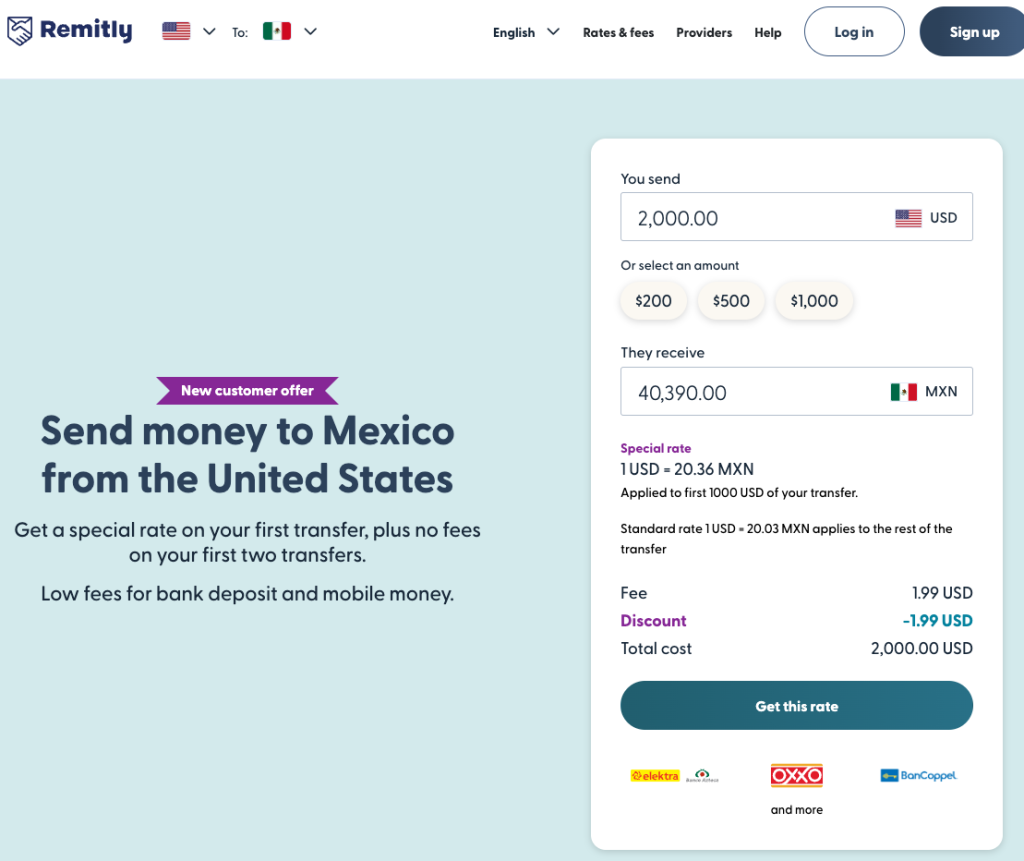

- Remitly, an American online remittance service founded in 2011 by Matthew Oppenheimer, Josh Hug, and Shivaas Gulati, is headquartered in Seattle, United States. The company provides international money transfer services to more than 170 countries. In September 2021, Remitly became publicly traded on the Nasdaq exchange (NASDAQ: RELY).

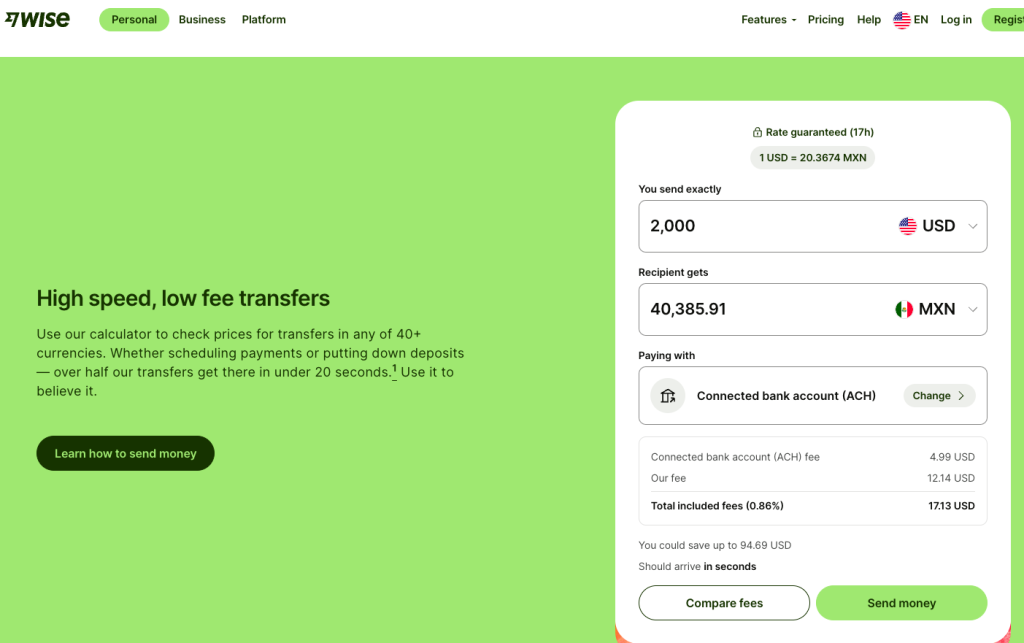

- Wise, previously known as TransferWise, is a financial technology company focused on global money transfers. Headquartered in London, it was founded by Kristo Käärmann and Taavet Hinrikus in January 2011. As of 2023, it offers three main products: Wise Account, Wise Business, and Wise Platform

- Xoom Corporation was founded in 2001 with its headquarters in San Francisco, California. In October 2012, in a follow-up survey by the Inter-American Dialogue of 51 remittance service providers for the US to Latin America market, ranked Xoom top for fees charged and countries served

Exchange Rate Comparison

In order to accurately compare the exchange rates offered by these platforms, let’s consider a scenario where we transfer $2000 from the United States to Mexico (as 12/18/2024)

MoneyGram

- Exchange rate: 1 USD = 19.8551 MXN

- New user promotion: For first time transfer at most $1000, the promotional exchange rate is 1 USD = 20.9289 MXN

Westen Union

- Exchange rate: 1 USD = 19.9522 MXN

- New user promotion: For first time transfer have better exchange rate and $0 fee

Remitly

- Exchange rate: 1 USD = 20.03 MXN

- New user promotion: For first time transfer at most $1000, the promotional exchange rate is 1 USD = 20.36 MXN

Wise

- Exchange rate: 1 USD = 20.3674 MXN (Having 0.86% fee, 1 USD = 20.18 MXN)

- New user promotion: For first time transfer at most $1000, the promotional exchange rate is 1 USD = 20.36 MXN

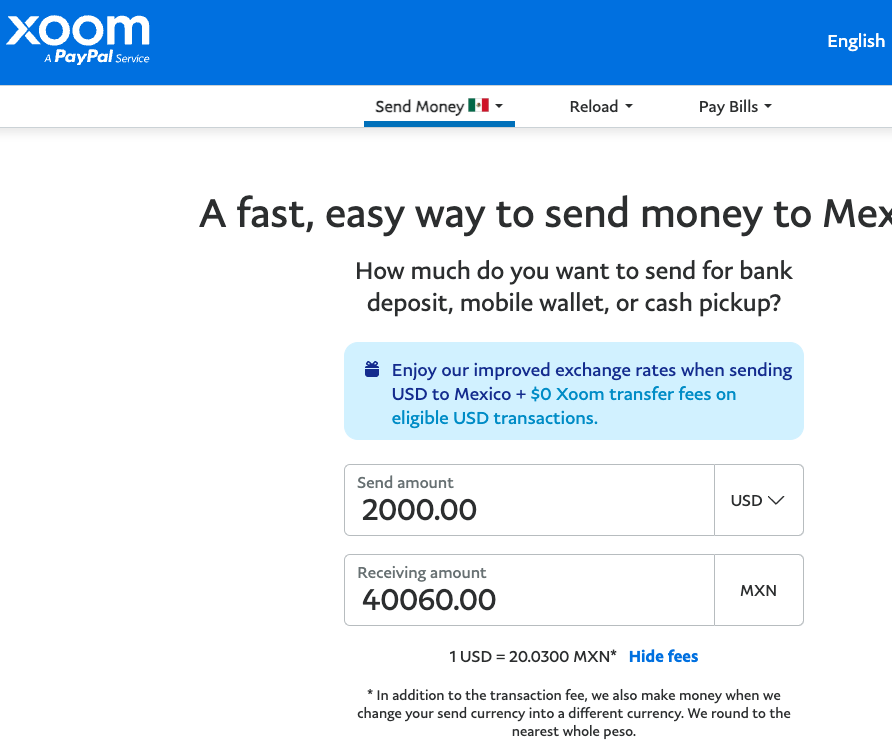

XOOM

- Exchange rate: 1 USD = 20.03 MXN

- New user promotion: N/A

Summary

The ranking of money transfer services based on exchange rates is as follows: Remitly offers the best rates, followed by Xoom, Wise, Western Union, and MoneyGram.

Note:

- To maximize savings, consider using multiple platforms to take advantage of the best rates and fees for different transfer scenarios.

- This comparison is based on exchange rates for transfers from the United States to Mexico. The ranking for exchange rates may vary depending on the destination country.

- Exchange rates and rankings are subject to change over time, so it’s important to check the latest rates before making a transfer.

- Transfer fees can significantly impact the total cost and vary depending on factors such as the funding source (bank account, credit card, etc.) and how the recipient receives the money (cash pickup, bank deposit, etc.).