Property tax payments can often be a significant financial burden. However, with the right strategies, you can make saving for these payments easier and reduce the strain on your budget. Here are three smart ways to save money when managing your property tax payments.

Avoid Putting Your Property Tax in an Escrow Account

A common practice among mortgage lenders is to include property tax payments in an escrow account along with your monthly mortgage payment. This approach guarantees timely tax payments but can also result in your funds being held. An alternative option is:

- Contact your mortgage lender to remove the property tax from your monthly payment.

- Handle the payment of your property tax personally when it’s due.

- Make sure to pay it on time yourself. Throughout the year, store your tax funds in a high-yield savings account to earn interest until payment is due.

Use PayPal BillPay for Certain Counties

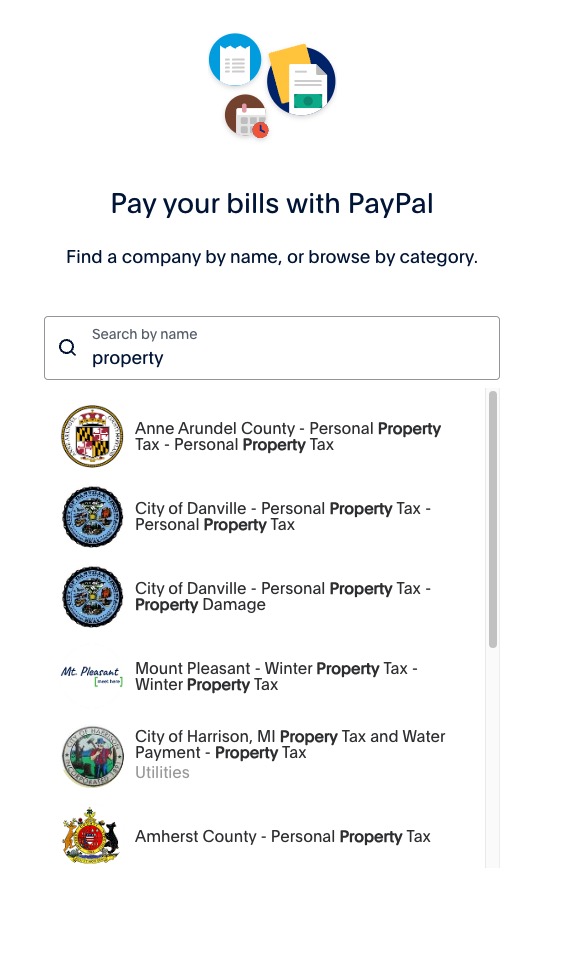

Many counties now allow you to pay your property taxes via PayPal, offering a convenient and streamlined way to handle your payments.

- Why use PayPal BillPay? Paypal BillPay is usually free of charge for the transaction. It often allows you to connect a rewards or cashback credit card, effectively transforming your tax payment into an opportunity to earn benefits.

- How to check eligibility: Visit paypal billpay page to see whether your county is accepting such payment

Pay Property Tax with Visa/Master/AMEX Giftcards

Many counties accept Visa, Mastercard, or American Express gift cards as a method of paying taxes. However, these transactions typically come with a convenience fee ranging from 2% to 2.5%. By purchasing these gift cards at a discount of more than 3%, it is possible to break even or even save money when using them.

- Certain credit cards provide substantial cashback rewards when you buy gift cards from retail stores within specific categories. Therefore, it can be beneficial to use the credit card to purchase these gift cards first and then utilize them for paying tax. For instance, the Amex Blue Cash Preferred card offers 6% cashback on purchases made at grocery stores.

- Buy visa/master/amex gift cards from website/stores with promotion: Visa/Master/Amex deals

Apply for New CreditCards to Pay For Property Tax

Getting a credit card with a good sign-up bonus can help with property tax payments. Many cards offer rewards once you spend a certain amount in the first few months. By using the card as payment, you can reach the spending goal quickly and earn a bonus that outweighs any fees. This turns your tax payment into a chance to save money or earn rewards.